I stumbled into an interesting discussion on Facebook yesterday, and didn’t have room to express my opinion there, so I thought I’d do it here. It’s about the economy, which has been my only real hobby for the past several years.

And hey, the economy is numbers-related so it’s not entirely off topic for this blog right? ![]()

Nobel Economist Paul Krugman Wants More “Stimulus Spending”

Stimulus spending is generally Mr. Krugman’s preferred fix for the US (and world) economy. Lately, he hasn’t been getting enough of it so he is on tour these days demanding more.

What exactly IS stimulus spending? Fundamentally it means “the government spends or gives away money.” The idea is that by injecting new money into the economy, it can kickstart a benevolent cycle that sustains itself:

- The people or businesses who receive the stimulus cash now have more money to spend on other things.

- As THEY spend their newfound money, other businesses have to hire more people to fill the demand.

- Those newly-employed workers now have more money to spend, and may even end up buying from the people who received the stimulus in step one.

Where Does the Government Get the Stimulus Cash?

It’s hard to argue with a fresh injection of money into the economy, and I highly recommend that the government should let ME play a big role in step #1 above. I am a willing conduit for your good works Paul, and honestly, the bigger the check the better. I can do a lot more good for the economy with, say, $100k than I can with $1k. I promise I will spend every penny in short order, no hoarding.

But as a society we really do need to ask where the money comes from in order to feel good about it. By my accounting, it can only come from a handful of places:

-

- Money that the government has saved

- Money that the government refunds directly to businesses and taxpayers via tax credits, rebates, or cuts

- Money raised by new taxes

- Money that the government just flat-out prints

- Money that is borrowed:

-

- From other governments

- From private corporations

- From banks, mutual funds, etc.

- From private investors

- From our own Federal Reserve

#1 kinda makes you laugh doesn’t it? Governments with saved money? Har har. Certainly not the US government. Does ANY government have money saved up? Assets exceeding liabilities? I need an accountant! Where’s David Churchward?

Anyway let’s take a look at the other sources.

#2 – Tax Refunds/Credits/Cuts

Again, allow me to be first to volunteer to have some of my tax dollars returned to me, and the more the better.

Jokes aside, this isn’t such a bad idea in general, but it has consequences. By taking in less money, the government now has less to spend on other things. And reduced spending on other things is really just REDUCING stimulus in other places – if they lay off federal workers for instance, or buy less Predator drones, the federal workers or the defense firms will have less money to spend into the economy, and we’re back where we started.

Tax refunds really just transfer “stimulus” from one place to another. So by itself, this one is no help.

#3 – New Taxes

Take more money out of the economy by raising taxes and then distribute it as stimulus = just another way of moving money around. Anti-stimulus one place, stimulus in another. Yields no net gain in stimulus.

#4 – Newly Printed Money

Now we’re getting somewhere. If we’re going to have some real economic kickstart without just moving money from one place to another, conjuring new money out of thin air is a pretty good way to source it. And the government, with the cooperation of the Federal Reserve, can do just that.

They’ve done a sizable amount of it lately, too. They don’t call it money printing though, they call it “Quantitative Easing.” (There’s a really funny video here too).

There are definitely real “ripple effects” from money printing that are not so good:

- If they increase the money supply by 10%, that reduces the purchasing power of the dollar by 10%, because supply and demand applies to dollars too, and prices of goods rise by 10% on average in response to more dollars in existence

- In other words, your dollars in the bank are now worth 10% less

- Similarly, the wages you receive from your job (or Social Security) are worth 10% less

- Even your investments (stocks, mutual funds, etc.) are worth less, unless they too appreciate by 10% as the money supply expands (which, actually, is reasonably likely)

- This is called inflation

So money printing is really just another form of taxation. It’s just a lot harder to connect the dots though, it’s a lot stealthier. Gasoline prices are higher? Blame the oil companies. Blame speculators. Just don’t blame the government’s stimulus packages ok?

Side Note: “Reverse Robin Hood”

Krugman’s book and blog are named “Conscience of a Liberal.” Some of his Nobel-winning work focused on rebuilding Haiti. He talks a lot about egalitarian redistribution of wealth to the average citizen. I don’t doubt that he’s sincerely trying to help people.

Krugman’s book and blog are named “Conscience of a Liberal.” Some of his Nobel-winning work focused on rebuilding Haiti. He talks a lot about egalitarian redistribution of wealth to the average citizen. I don’t doubt that he’s sincerely trying to help people.

(And I, by the way, have no political affiliation – I don’t have a team that I root for, I actually think both of our teams here in the US are doing an equally awful job.)

So I wonder how he “squares” his egalitarian goals with these two facts:

1) Wealthier citizens have a much easier time shielding themselves from inflation

More sophisticated investors always do a better job outpacing inflation than the average citizen. So the average citizen bears a disproportionate share of the “costs” of money printing. The rich get richer, while both the poor AND the middle class get poorer.

2) Newly-printed money tends to enter the economy through the financial system

It’s a long story, but most newly-printed money goes to Wall Street before it goes anywhere else.

So again, money printing benefits the richest segment of society disproportionately – sure, their dollars are worth 10% less just like us, but their well-placed investments mitigate that, AND they receive the new money first. So their net wealth, in dollars, increases by more than 10%, and they actually come out ahead.

The rest of us pay the bill. This is so plain to me after a few years of reading that I wonder how it escapes him. Or maybe I am missing something crucial.

#5 – Borrowed Money

Here’s another way to “create” new money without just moving it around. Borrow it from someone else.

But actually that doesn’t create money either. It’s another transfer. In order to lend money to the government, I have to have excess money lying around. I COULD use that money to just buy goods and services, and that would have the stimulating effect that Krugman desires.

But instead, I loan it to the government (you hear about this all the time – it’s called “buying Treasuries” or “buying T-bills”) so THEY can take care of the stimulus distribution. It’s just another transfer within the system, no net gain in stimulus.

But there’s a catch: it’s a loan, with interest, and the government then owes me back more money than I gave them. Eek.

Even better: the people lending the most money to the government again tend to be the wealthiest individuals and institutions. So not only is borrowed money a “net zero” transfer within the system, it again disproportionately enriches the already rich.

Borrowing from other countries is a good trick in the sense that it is NOT a transfer within the system – money IS coming in from outside the system if it’s coming from China, as long as you view the US as a relatively closed system (which is at least partly true).

But since we have to pay it all back, with interest, we’re really borrowing from our own future.

Of course, there’s always the chance that we will NOT pay it back, as driven home by yet another hilarious video. Then it truly is a Good Deal… for us.

“Hey Rob, you got a problem with the rich?”

Hell no. I’ve been working harder these past couple of years than ever before in my career, and it’s not just because I enjoy it. There are incentives for building a business from scratch like we are doing, if we are successful.

I actually think the whole “99% versus 1%” thing is quite misplaced. We should all be striving to BE the 1% – I’m not there yet, and maybe never will be, but I sure won’t feel guilty for trying. The things we do at Pivotstream are quite productive and helpful to our customers. It’s easy for me to trace our benefit to those around us, and if we stopped benefiting them, that would be a bad sign for our business, as it should be.

I think a better framing of the battle lines would be the “99.99% versus the 0.01%,” or actually more accurately, “earned income versus unearned income.”

Look, Bill Gates and Steve Jobs changed the world emphatically. They truly earned their billions.

Similarly, I think “real” investors like venture capitalists also earn their money, as covered in my Thanksgiving post from two years back.

But money that is made purely in financial markets isn’t earned in the same way as money earned via those other methods. Financial market activity is a necessary lubricant, but then again so is the legal profession. If we woke up one day and found that the legal profession was nearly 15% of our economy, as is the case with Wall Street, we’d immediately understand that something was wrong.

And even better: unearned income is taxed at a much lower rate than earned income. Sometimes it’s not taxed at all. Warren Buffet paying less taxes than his secretary is a sign of a diseased system, one that incents the wrong things (creation and defense of wealth without proportionate benefit to society).

What’s wrong with a loan, really?

Businesses take loans all the time to get off the ground, or to expand operations in some significant manner. And society DOES benefit from that real growth.

So is it the same thing for the government to do that? Yes and no, is my answer. No because governments don’t typically allocate investment as effectively as the private sector, but yes because if they DO invest properly, sometimes the benefits can even be GREATER than if the private sector did it.

Common infrastructure like the interstate system for instance is not something the private sector ever would (or could) have built. Investments like that enable the private sector to then do things that never would have been possible before.

There certainly is a need for renewed investment in our infrastructure in the US (alternative energy and transportation come to mind, as well as improvements in education and job training). Have you noticed any big projects on the scale of mid-twentieth century investments like the interstate system or the space program? Yeah me either.

The other problem with loans: exponentially-growing debt

If you borrow from time to time in order to expand your company, and then the new productive capacity of your company lets you pay off that debt, great.

But if you start to use debt in an endless cycle, and you become dependent on it all the time, it will crush you.

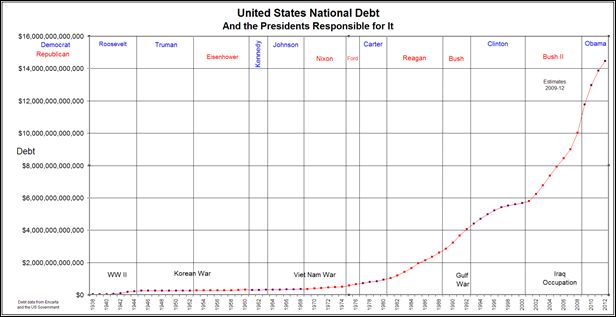

Check out our US government debt:

It took over 200 years to amass our first $6T in debt, then about 8 years to amass the second $6T, and we’re on pace to continue.

My question to Krugman on debt, then, is “if this isn’t enough debt, how much IS? Would another $1T in loans and stimulus save us where the last six to ten TRILLION has not?”

“Follow the goods and services, not the money”

I think this is the most useful thing I have ever heard from an economist, but it wasn’t Krugman (I forget who, it was years ago). We get too distracted by money, which is really just a medium for exchange, a lubricant, for REAL economic activity. Real activity is all that truly matters, because money is worthless paper if you don’t exchange it for something real.

Take the example above: stimulus spent on infrastructure can enable further productive activity that was impossible before. Productive investments like that increase the size of the overall pie.

By contrast, stimulus money that ultimately gets spent on new clothes, or a hardwood floor, or sports tickets, is just re-allocation of “wealth” within a pie of a fixed size.

It’s the same with the earned/unearned income thing. Earned income is productive, unearned income is largely the art of siphoning wealth from the productive.

“But Krugman Has a Nobel in Economics, Rob Has a Tech Blog”

Fair point. I feel a bit weird about saying that this dude doesn’t know what he’s doing. But I really think he doesn’t. So why do I think someone that smart and that decorated can be so wrong?

Too Much Greek in the Math, Too Much Ivory in the Tower

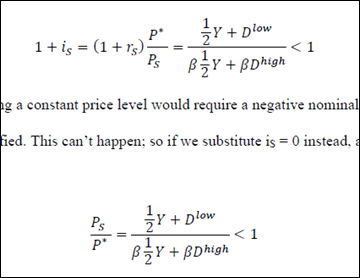

If you crack open one of Krugman’s papers you are bound to see stuff like this:

Hey that’s fancy. This is a big part of the world he lives in – that paper is half equations. Go check his wikipedia entry – the man has never left academia. On matters of the economy, why we would ever listen to someone who has never “tasted” anything to do with real business, but instead wraps himself in equations all day long, is beyond me.

It’s ironic for me, former Calculus Team captain in high school and proud owner of a number-crunching career, to make fun of someone for loving them some equations. I debated grad school for awhile and almost went – if so, today I might be a lot like Krugman (only less decorated than he, and many times more bitter toward him).

But in my real-world experience with any form of complex system, the more “advanced” your equations become, and the less tempered they are by tangible experience, the more they diverge from reality. If we were interviewing him for the job of economic adviser, his ability to wow us with equations wouldn’t be enough. We’d want real answers to the sorts of questions above. And given that his Nobel was awarded by a committee who similarly has lived in “isolated equation land” their entire lives, you start to realize that this could very well be a subculture that is completely alienated from anything real, and simply rewarding one of their own.

Too Little Friction in the Physics

You see the part in the image above where he says “this can’t happen, so..”

The paper is littered with stuff like that too. That, and “taking as a given,” and “obviously,” and other ways to describe critical assumptions. Papers like these are built on pyramids of those, and if any one of those assumptions proves to be untrue, even for a very brief period of time, it can all crumble down quickly.

It reminds me of high school physics, where half of the problems we had to solve started with “assume friction is zero” or “assume air resistance is negligible” or my personal favorite, “an object is moving through a vacuum…’

Great way to learn the theory, but you eventually have to deal with the dirty, noisy, friction-equipped real world.